Pursuant to the recommendations made by the Financial Action Task Force on anti-money laundering standards, SEBI had issued the guidelines on Anti Money Laundering Standards vide their Circular No. ISD/CIR/RR/AML/1/06 dated 18th January 2006, vide Circular No. ISD/CIR/RR/AML/2/06 dated 20th March 2006 and vide Circular No. CIR/MIRSD/1/2014 dated 12th March 2014 had issued the obligations of the intermediaries registered under section 12 of SEBI Act, 1992.

The Government of India has serious concerns over money laundering activities, which are not only illegal but anti-national as well. Money laundering is the process by which large amount of illegally obtained money (from drug trafficking, terrorist activity or other serious crimes) is given the appearance of having originated from a legitimate source. All crimes that produce a financial benefit give rise to money laundering.

As per these SEBI guidelines, all intermediaries have been advised to ensure that proper policy frameworks are put in place as per the Guidelines on Anti Money Laundering Standards notified by SEBI and they shall be able to satisfy themselves that the measures taken by them are adequate , appropriate and abide by the spirit of such measures and the requirements as enshrined in the PMLA.

As a market participant it is evident that strict and vigilant tracking of all transactions of suspicious nature required.

Accordingly the Company has laid down following policy guidelines:

Principal Officer ( As per provision 76 of Master Circular as per SEBI Circular SEBI/HO/MIRSD/MIRSDSECFATF/P/CIR/2024/78 dated June 06, 2024) :

Principal Officer is responsible for implementation of internal controls & procedures for identifying and reporting any suspicious transaction or activity to the concerned authorities. Principle officer has the right of timely access to customer identification data, other CDD information and is able to report the same to senior management or the board of directors.

a. In terms of Rule 2 (f) of the PML Rules, the definition of a Principal Officer reads as under:

Principal Officer means an officer designated by a registered intermediary; Provided that such officer shall be an officer at the management level.

Designated Director ( As per provision 77 of Master Circular as per SEBI Circular SEBI/HO/MIRSD/MIRSDSECFATF/P/CIR/2024/78 dated June 06, 2024) :

Designated Director of the company is appointed in terms of rule 2 (ba) of the PML rules. He will be responsible for ensure overall compliance with the obligations imposed under chapter IV of the Act and the Rules.

“Designated director means a person designated by the reporting entity to ensure overall compliance with the obligations imposed under chapter IV of the Act and the Rules and includes –

Purpose & Scope:

As a Financial Market Intermediary (which includes a stock-broker, authorised person and any other intermediary associated with securities market and registered under Securities and Exchange Board of India) we need to maintain a record of all the transactions; the nature and value of which has been prescribed in the Rules under the PMLA. Accordingly all the back office and trading staff is instructed to observe the following safeguards:

1 No Cash transactions for trading in securities shall be allowed from any client in the normal course of business.

2 Maintain a record of all the transactions; the nature and value of which has been prescribed in the Rules notified under the PMLA. Such transactions include:

a) All Cash transactions of the value of more than Rs 10 lakhs or its equivalent in foreign currency.

b) All series of cash transactions integrally connected to each other which have been valued below Rs 10 lakhs or its equivalent in foreign currency where such series of transactions have taken place within a month and the monthly aggregate exceeds an amount of ten lakh rupees or its equivalent in foreign currency

c) All suspicious transactions whether or not made in cash and including, inter-alia, credits or debits into from any non monetary account such as Demat account, security account maintained by us.

3 For the purpose of suspicious transactions reporting, apart from ‘transactions integrally connected’, ‘transactions remotely connected or related’ shall also be considered. (More stringent requirement applicable in case, there is a variance in CDD/AML standards prescribed by SEBI and the regulators of the host country, branches/overseas subsidiaries of intermediaries)

4 As per provision 7 of Master Circular as per SEBI Circular SEBI/HO/MIRSD/MIRSDSECFATF/P/CIR/2024/78 dated June 06, 2024

a. If the host country does not permit the proper implementation of AML/CFT measures consistent with the home country requirements, we will be required to apply appropriate additional measures to manage the ML/TF risks and inform SEBI.

5 Frequent off Market transfers from one BO account to another shall be scrutinized and asked for. In absence of valid reason case or found suspicious, it shall be brought to the notice of Principal Officer / Designated Director.

6 Trading beyond ones declared income: The turnover of the clients should be according to their declared means of income. Any abnormal increase in client’s turnover shall be reported to Principal Officer / Designated Director. The Back Office staff should take due care in updating the clients’ financial details and shall periodically review the same.

Policies & Procedures:

A) Client identification procedure:

The ‘Know your Client’ (KYC) Policy: -

a) While establishing the intermediary – client relationship

- No account shall be opened unless all the KYC Norms as prescribed from time to time by the SEBI / Exchanges are duly complied with, all the information as required to be filled in the KYC form (including financial information, occupation details and employment details) is actually filled in and the documentary evidence in support of the same is made available by the client. Moreover all the supporting documents should be verified with originals and client should sign the KYC & MCA in presence of our own staff and the client should be introduced by an existing clients or the known reference.

- The information provided by the client should be checked though independent source namely.

- Pan Number must be verified from Income Tax We Site

- Address must be verified by sending Welcome Letter to the client, and in case any document returned / undelivered then we asked from the client to provide his new address proof before doing any further transaction.

As per provision 2.2.5.1 of SEBI’s AML Master Circular dated 4 th July, 2018 – PEP Clients

In case we have reasons to believe that any of our existing / potential customer is a politically exposed person (PEP) we must exercise due diligence, to ascertain whether the customer is a politically exposed person (PEP), which would include seeking additional information from clients and accessing publicly available information / commercial electronic databases of PEPs etc.

b. The dealing staff must obtain senior management`s prior approval for establishing business relationships with Politically Exposed Persons. In case an existing customer is subsequently found to be, or subsequently becomes a PEP, dealing staff must obtain senior management`s approval to continue the business relationship.

c. We must take reasonable measures to verify source of funds of clients as well as wealth of the clients and beneficial owners identified as PEP.

d. The client shall be identified by us by using reliable sources including documents / information. We shall obtain adequate information to satisfactorily establish the identity of each new client and the purpose of the intended nature of the relationship.

e. The information must be adequate enough to satisfy competent authorities (regulatory / enforcement authorities) in future that due diligence was observed by us in compliance with the directives. Each original document shall be seen prior to acceptance of a copy.

f. Failure by prospective client to provide satisfactory evidence of identity shall be noted and reported to the higher authority.

g. As per provision 3.7 of Amendment as per SEBI Circular SEBI/HO/MIRSD/SEC-FATF/P/CIR/2023/0170 dated October 13, 2023 :

a. PEP shall also be applied to the accounts of the family members or close relatives / associates of PEPs

b) While carrying out transactions for the client

- RMS department should monitor the trading activity of the client and exercise due diligence to ensure that the trading activity of the client is not disproportionate to the financial status and the track record of the client.

- Payments department should ensure that payment received form the client is being received in time and through the bank account the details of which are given by the client in KYC form and the payment through cash / bearer demand drafts should not be entertained.

B) Obligation to established policies and procedure ( As per provision 8 to 12 of Master Circular as per SEBI Circular SEBI/HO/MIRSD/MIRSDSECFATF/P/CIR/2024/78 dated June 06, 2024 ) :

a) We have developed our internal procedure to include the Global measures taken to combat drug trafficking, terrorism and other organized and serious crimes have all emphasized the need for financial institutions, including securities market intermediaries, to establish internal procedures that effectively serve to prevent and impede money laundering and terrorist financing.

b) The term “group" shall have the same meaning assigned to it in clause (cba) of sub-rule (1) of Rule 2 of the PML Rules as amended from time to time. Groups shall implement group-wide policies for the purpose of discharging obligations under Chapter IV of the PMLA.

c) Implement group wide programmes for dealing with ML/TF

d) Our senior management shall be fully committed to establishing appropriate policies and procedures for the prevention of ML and TF and ensuring their effectiveness and compliance with all relevant legal and regulatory requirements.

C) Policy for acceptance of clients ( As per provision 18 of Master Circular as per SEBI Circular SEBI/HO/MIRSD/MIRSDSECFATF/P/CIR/2024/78 dated June 06, 2024 ) :

We have developed client acceptance policies and procedures that aim to identify the types of clients that are likely to pose a higher than average risk of ML (Money Laundering) or TF (Terrorist Financing):

The above mentioned list is only illustrative and the intermediary shall exercise independent judgment to ascertain whether any other set of clients shall be classified as CSC or not.

d. Documentation requirements and other information to be collected in respect of different classes of clients depending on the perceived risk and having regard to the requirements of Rule 9 of the PML Rules, Directives and Circulars issued by SEBI from time to time.

e. Ensure that an account is not opened where the we unable to apply appropriate CDD measures. This shall apply in cases where it is not possible to ascertain the identity of the client, or the information provided to the intermediary is suspected to be non - genuine, or there is perceived non - co-operation of the client in providing full and complete information. The registered intermediary shall not continue to do business with such a person and file a suspicious activity report. It shall also evaluate whether there is suspicious trading in determining whether to freeze or close the account. The registered intermediary shall be cautious to ensure that it does not return securities or money that may be from suspicious trades. However, the registered intermediary shall consult the relevant authorities in determining what action it shall take when it suspects suspicious trading.

f. The circumstances under which the client is permitted to act on behalf of another person / entity shall be clearly laid down. It shall be specified in what manner the account shall be operated, transaction limits for the operation, additional authority required for transactions exceeding a specified quantity/value and other appropriate details. Further the rights and responsibilities of both the persons i.e. the agent-client registered with the intermediary, as well as the person on whose behalf the agent is acting shall be clearly laid down. Adequate verification of a person’s authority to act on behalf of the client shall also be carried out.

g. Necessary checks and balance to be put into place before opening an account so as to ensure that the identity of the client does not match with any person having known criminal background or is not banned in any other manner, whether in terms of criminal or civil proceedings by any enforcement agency worldwide.

h. The CDD process shall necessarily be revisited when there are suspicions of ML/TF.

Risk – Based Approach ( As per provision 2.2.3 of SEBI’s AML Master Circular dated 4 th July, 2018) :

i. It is generally recognized that certain clients may be of a higher or lower risk category depending on the circumstances such as the client’s background, type of business relationship or transaction etc. As such, we have applied each of the clients due diligence measures on a risk sensitive basis. The basic principle enshrined in this approach is that we adopt an enhanced client due diligence process for higher risk categories of clients. Conversely, a simplified client due diligence process may be adopted for lower risk categories of clients. In line with the risk-based approach, the type and amount of identification information and documents that we obtain necessarily depend on the risk category of a particular client.

ii. In case where suspicious of ML/TF to any client, low risk provision should not applied to such clients or when other factors give rise to a belief that the customer does not in fact pose a low risk

iii. Risk Assessment –

1. We have carried out risk assessment to identify, assess and take effective measures to mitigate money laundering and terrorist financing risk with respect to our clients, countries or geographical areas, nature and volume of transactions, payment methods used by clients, etc. The risk assessment shall also take into account any country specific information that is circulated by the Government of India and SEBI from time to time, as well as, the updated list of individuals and entities who are subjected to sanction measures as required under the various United Nations' Security Council Resolutions (these can be accessed at the URL - http://www.un.org/sc/committees/1267/aq_sanctions_list.shtml and http://www.un.org/sc/committees/1988/list.shtml)

2. The risk assessment carried out shall consider all the relevant risk factors before determining the level of overall risk and the appropriate level and type of mitigation to be applied. We have documented such risk assessment, updated regularly and made available to competent authorities and self-regulating bodies, as and when required.

Client Due Diligence ( As per provision 14 to 17 of Master Circular as per SEBI Circular SEBI/HO/MIRSD/MIRSDSECFATF/P/CIR/2024/78 dated June 06, 2024 ) :

i. where the client is a company , the beneficial owner is the natural person(s), who, whether acting alone or together, or through one or more juridical person, has a controlling ownership interest or who exercises control through other means.

Explanation:- For the purpose of this sub-clause:-

1. "Controlling ownership interest" means ownership of or entitlement to more than ten per cent (10%) of shares or capital or profits of the company;

2. "Control" shall include the right to appoint majority of the directors or to control the management or policy decisions including by virtue of their shareholding or management rights or shareholders’ agreements or voting agreements;

ii. where the client is a partnership firm, the beneficial owner is the natural person(s) who, whether acting alone or together, or through one or more juridical person, has ownership of/ entitlement to more than ten percent of capital or profits of the partnership or who exercises control through other means.

Explanation:- For the purpose of this clause:-

“Control” shall include the right to control the management policy decision;

iii. where the client is an unincorporated association or body of individuals, the beneficial owner is the natural person(s), who, whether acting alone or together, or through one or more juridical person, has ownership of or entitlement to more than fifteen per cent (15%). of the property or capital or profits of such association or body of individuals;

iv. where no natural person is identified under (a) or (b) or (c) above, the beneficial owner is the relevant natural person who holds the position of senior managing official;

v. Where the client is a trust , the identification of beneficial owner(s) shall include identification of the author of the trust, the trustee, the beneficiaries with ten per cent or more interest in the trust, settlor, protector and any other natural person exercising ultimate effective control over the trust through a chain of control or ownership; and

vi. where the client or the owner of the controlling interest is an entity listed on a stock exchange in India, or it is an entity resident in jurisdictions notified by the Central Government and listed on stock exchanges in such jurisdictions notified by the Central Government, or it is a subsidiary of such listed entities, it is not necessary to identify and verify the identity of any shareholder or beneficial owner of such entities.

vii. Applicability for foreign investors : Registered intermediaries dealing with foreign investors’ may be guided by SEBI Master Circular SEBI/HO/AFD-2/CIR/P/2022/175 dated December 19, 2022 and amendments thereto, if any, for the purpose of identification of beneficial ownership of the client;

D) Hiring and Training of Employees and Investor Education (As per provision 44 to 49 of Master Circular as per SEBI Circular SEBI/HO/MIRSD/MIRSDSECFATF/P/CIR/2024/78 dated June 06, 2024)

a. The HR Department is instructed to cross check all the references and should take adequate safeguards to establish the authenticity and genuineness of the persons before recruiting. The department should obtain the following documents:

1 Photographs

2 Proof of address

3 Identity proof

4 Proof of Educational Qualification

5 References

b. Hiring of Employees: Adequate screening procedures in place to ensure high standards when hiring employees. Identify the key positions within organization structures having regard to the risk of money laundering and terrorist financing and the size of their business and ensure the employees taking up such key positions are suitable and competent to perform their duties.

c. Training of Employees: We must conduct an ongoing employee training programme so that the our staff are adequately trained in AML and CFT procedures. Training requirements shall have specific focuses for frontline staff, back office staff, compliance staff, risk management staff and staff dealing with new clients. It is crucial that all those concerned fully understand the rationale behind these directives, obligations and requirements, implement them onsistently and are sensitive to the risks of their systems being misused by unscrupulous elements.

d. Investor Education: Implementation of AML/CFT measures requires registered intermediaries to demand certain information from investors which may be of personal nature or has hitherto never been called for. Such information can include documents evidencing source of funds/income tax returns/bank records etc. This can sometimes lead to raising of questions by the client with regard to the motive and purpose of collecting such information. There is, therefore, a need for registered intermediaries to sensitize their clients about these requirements as the ones emanating from AML and CFT framework. Registered intermediaries shall prepare specific literature/ pamphlets etc. so as to educate the client of the objectives of the AML/CFT programme.

E) Record Keeping ( As per provision 44 to 49 of Master Circular as per SEBI Circular SEBI/HO/MIRSD/MIRSDSECFATF/P/CIR/2024/78 dated June 06, 2024)

a. We ensure compliance with the record keeping requirements contained in the SEBI Act, 1992, Rules and Regulations made there-under, PMLA as well as other relevant legislation, Rules, Regulations, Exchange Byelaws and Circulars.

b. We maintain such records as are sufficient to permit reconstruction of individual transactions (including the amounts and types of currencies involved, if any) so as to provide, if necessary, evidence for prosecution of criminal behaviour.

c. If there be any suspected drug related or other laundered money or terrorist property, our competent investigating authorities need to trace through the audit trail for reconstructing a financial profile of the suspect account. To enable this reconstruction, we retain the following information for the accounts of their customers in order to maintain a satisfactory audit trail:

i. the beneficial owner of the account;

ii. the volume of the funds flowing through the account; and

iii. for selected transactions:

1. the origin of the funds;

2. the form in which the funds were offered or withdrawn, e.g. cash, cheques, etc.;

3. the identity of the person undertaking the transaction;

4. the destination of the funds;

5. the form of instruction and authority.

d. We ensure that all customer and transaction records and information are available on a timely basis to the competent investigating authorities. Where appropriate, they should consider retaining certain records, e.g. customer identification, account files, and business correspondence, for periods which may exceed that required under the SEBI Act, Rules and Regulations framed there-under PMLA 2002, other relevant legislations, Rules and Regulations or Exchange bye-laws or circulars.

e. We have a system of maintaining proper record of the nature and value of transactions which has been prescribed under Rule 3 of PML Rules as mentioned below:

i. all cash transactions of the value of more than ten lakh rupees or its equivalent in foreign currency;

ii. all series of cash transactions integrally connected to each other which have been individually valued below rupees ten lakh or its equivalent in foreign currency where such series of transactions have taken place within a month and the monthly aggregate exceeds an amount of ten lakh rupees or its equivalent in foreign currency;

It may, however, be clarified that for the purpose of suspicious transactions reporting, apart from ‘transactions integrally connected’, ‘transactions remotely connected or related’ shall also be considered.

iii. all cash transactions where forged or counterfeit currency notes or bank notes have been used as genuine or where any forgery of a valuable security or a document has taken place facilitating the transactions;

iv. all suspicious transactions whether or not made in cash and including, inter-alia, credits or debits into or from any non-monetary account such as demat account, security account maintained by the registered intermediary.

f. Where we do not have records of the identity of our existing clients, it shall obtain the records forthwith, failing which we shall close the account of the clients after giving due notice to the client.

Explanation: For this purpose, the expression “records of the identity of clients” shall include updated records of the identification date, account files and business correspondence and result of any analysis undertaken under Rules 3 and 9 of the PML Rules.

F) Retention of records ( As per provision 50 to 53 of Master Circular as per SEBI Circular SEBI/HO/MIRSD/MIRSDSECFATF/P/CIR/2024/78 dated June 06, 2024

a. We shall take appropriate steps to evolve an internal mechanism for proper maintenance and preservation of such records and information in a manner that allows easy and quick retrieval of data as and when requested by the competent authorities. Further, the records mentioned in Rule 3 of PML Rules have to be maintained and preserved for a period of five years from the date of transactions between the client and intermediary.

b. We are required to formulate and implement the CIP containing the requirements as laid down in Rule 9 of the PML Rules and such other additional requirements that it considers appropriate. Records evidencing the identity of its clients and beneficial owners as well as account files and business correspondence shall be maintained and preserved for a period of five years after the business relationship between a client and intermediary has ended or the account has been closed, whichever is later.

c. In situations where the records relate to on-going investigations or transactions which have been the subject of a suspicious transaction reporting, they shall be retained until it is confirmed that the case has been closed.

d. We shall maintain and preserve the records of information related to transactions, whether attempted or executed, which are reported to the Director, FIU – IND, as required under Rules 7 and 8 of the PML Rules, for a period of five years from the date of the transaction between the client and the intermediary.

G) Record Management ( As per provision 43 of Master Circular as per SEBI Circular SEBI/HO/MIRSD/MIRSDSECFATF/P/CIR/2024/78 dated June 06, 2024 )

Company will maintain and preserve the following information in respect of transactions referred to in Rule 3 of PMLA Rules (at present period minimum specified period is 8 years)

a. the nature of the transactions;

b. the amount of the transaction and the currency in which it is denominated;

c. the date on which the transaction was conducted; and

d. the parties to the transaction

H) Records of information reported to the Director, Financial Intelligence

Unit - India (FIU-IND):

Company will maintain and preserve the record of information related to transactions, whether attempted or executed, which are reported to the Director, FIU-IND, as required under Rules 7 & 8 of the PML Rules

I) Employees’ Training ( As per provision 2.12.2 of SEBI’s AML master circular dated 4 th July, 2018 )

Company adopted an ongoing employee training program so that the members of the staff are adequately trained in AML and CFT procedures. Training requirements have specific focuses for frontline staff, back office staff, compliance staff, risk management staff and staff dealing with new customers. It is crucial that all those concerned fully understand the rationale behind these guidelines, obligations and requirements, implement them consistently and are sensitive to the risks of their systems being misused by unscrupulous elements.

J) Investors Education ( As per provision 2.12.3 of SEBI’s AML master circular dated 4 th July, 2018 )

Implementation of AML/CFT measures requires back office and trading staff to demand certain information from investors which may be of personal nature or which have hitherto never been called for. Such information can include documents evidencing source of funds/income tax returns/bank records etc. This can sometimes lead to raising of questions by the customer with regard to the motive and purpose of collecting such information. There is, therefore, a need for the back office and trading staff to sensitize their customers about these requirements as the ones emanating from AML and CFT framework. The back office and trading staff should prepare specific literature/ pamphlets etc. so as to educate the customer of the objectives of the AML/CFT programme.

K) Monitoring of Transactions (As per provision 2.6 of SEBI’s AML master circular dated 4 th July, 2018 )

a. We have understood the normal activity of the client so that it can identify deviations in transactions / activities.

b. We pay special attention to all complex unusually large transactions / patterns which appear to have no economic purpose. We may specify internal threshold limits for each class of client accounts and pay special attention to transactions which exceeds these limits. The background including all documents/office records /memorandums/clarifications sought pertaining to such transactions and purpose thereof shall also be examined carefully and findings shall be recorded in writing. Further such findings, records and related documents shall be made available to auditors and also to SEBI/stock exchanges/FIUIND/ other relevant Authorities, during audit, inspection or as and when required.

c. We shall ensure a record of the transactions is preserved and maintained in terms of Section 12 of the PMLA and that transaction of a suspicious nature or any other transactions notified under Section 12 of the Act are reported to the Director, FIU-IND. Suspicious transactions shall also be regularly reported to the higher authorities within the intermediary.

d. Further, our compliance cell shall randomly examine a selection of transactions undertaken by clients to comment on their nature i.e. whether they are in the nature of suspicious transactions or not.

L) Suspicious Transaction Monitoring & Reporting ( As per provision 38 to 42 of Master Circular as per SEBI Circular SEBI/HO/MIRSD/MIRSDSECFATF/P/CIR/2024/78 dated June 06, 2024)

a. We ensure to take appropriate steps to enable suspicious transactions to be recognised and have appropriate procedures for reporting suspicious transactions. While determining suspicious transactions, we should be guided by definition of suspicious transaction contained in PML Rules as amended from time to time.

b. A list of circumstances which may be in the nature of suspicious transactions is given below. This list is only illustrative and whether a particular transaction is suspicious or not will depend upon the background, details of the transactions and other facts and circumstances:

i. Clients whose identity verification seems difficult or clients appears not to cooperate

ii. Asset management services for clients where the source of the funds is not clear or not in keeping with clients apparent standing /business activity;

iii. Clients in high-risk jurisdictions;

iv. Substantial increases in business without apparent cause;

v. Clients transferring large sums of money to or from overseas locations with instructions for payment in cash;

vi. Attempted transfer of investment proceeds to apparently unrelated third parties;

vii. Unusual transactions by CSCs and businesses undertaken by offshore banks /financial services, businesses reported to be in the nature of export-import of small items.

c. If any suspicion transaction found then it should be immediately notified to the Designate / Principal Officer within the company. The notification may be done in the form of a detailed report with specific reference to the clients, transactions and the nature /reason of suspicion. However, it shall be ensured that there is continuity in dealing with the client as normal until told otherwise and the client shall not be told of the report/ suspicion. In exceptional circumstances, consent may not be given to continue to operate the account, and transactions may be suspended, in one or more jurisdictions concerned in the transaction, or other action taken. The Designated/ Principal Officer and other appropriate compliance, risk management and related staff members shall have timely access to client identification data and CDD information, transaction records and other relevant information.

d. It is likely that in some cases transactions are abandoned /aborted by customers on being asked to give some details or to provide documents. It is clarified that we should report all such attempted transactions in STRs, even if not completed by customers, irrespective of the amount of the transaction.

e. Paragraph 18 (iii) (f) of this Circular ( SEBI Circular SEBI/HO/MIRSD/MIRSDSECFATF/P/CIR/2024/78 dated June 06, 2024) categorizes clients of high risk countries, including countries where existence and effectiveness of money laundering controls is suspect or which do not or insufficiently apply FATF standards, as ‘CSC’. We are directed that such clients shall also be subject to appropriate counter measures. These measures may include a further enhanced scrutiny of transactions, enhanced relevant reporting mechanisms or systematic reporting of financial transactions, and applying enhanced due diligence while expanding business relationships with the identified country or persons in that country etc.

Procedure for freezing of funds, financial assets or economic resources or related services (As per provision 1.3.2.2 of SEBI’s AML master circular dated July 04, 2018 and as per the SEBI Circular SEBI/HO/MIRSD/DOP/CIR/P/2019/69 dated May 28, 2019 vide

Order of Government of India, Ministry of Home Affairs – CTCR Division-March, 2019

Order of Government of India, Ministry of Home Affairs – CTCR Division-2 nd February, 2021 )

i. In case, the particular of any of the customer match with the particular of designated individual / entities, intermediaries regulated by SEBI shall immediately, not later than 24 hours from the time of finding out such customer, inform full particular of the funds, financial assets or economic resources or related services held with bank accounts, stocks or insurance policies held by such customer on their books to the Central (Designated) Nodel Officer for the UAPA.

ii. Also send a copy of the communication mentioned in (i) above to the UAPA Nodel Officer of the State/UT, where the account is held and Regulars and FIU/IND, as the case may be.

iii. In the event, particulars of any of customers match the particulars of designated individuals/entities (updated list of individuals/ entities subject to UN sanction measures) is beyond doubt, we are liable to immediately, not later than 24 hours from the time of finding out such customer, inform full particulars of the funds, financial assets or economic resources or related services held in the form of securities, held by such customer on their books to the Central (designated) Nodel Offiers for UAPA at fax No. 011-23092551 and also convey over telephone on 011-23092548. The particulars apart from being sent by post should necessarily be conveyed through e-mail at jsctcr-mha@gov.in.

As per provision 1.3.2.2 of SEBI’s AML master circular dated July 04, 2018 ,

As per provision 1.3.2.3 of SEBI’s AML master circular dated July 04, 2018 ,

a) Role of internal audit or compliance function to ensure compliance with the policies, procedures, and controls relating to the prevention of ML and TF, including the testing of the system for detecting suspected money laundering transactions, evaluating and checking the adequacy of exception reports generated on large and/or irregular transactions, the quality of reporting of suspicious transactions and the level of awareness of front line staff, of their responsibilities in this regard. The internal audit function shall be independent, adequately resourced and commensurate with the size of the business and operations, organization structure, number of clients and other such factors.

Supplementary Guidelines for detecting suspicious transactions under rule 7(3) of Prevention of Money Laundering (Maintenance of Records) Rules, 2005 of FIU Circular dated 21 st July, 2022 ,

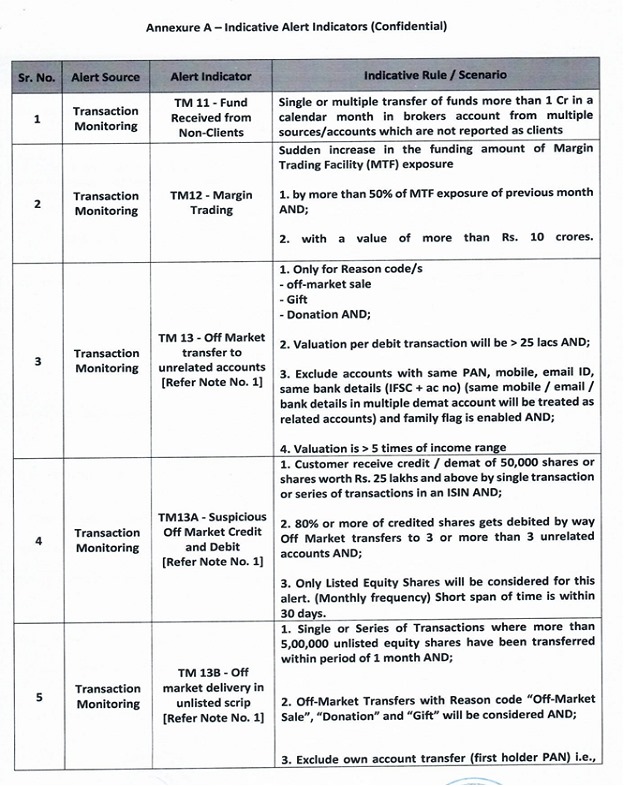

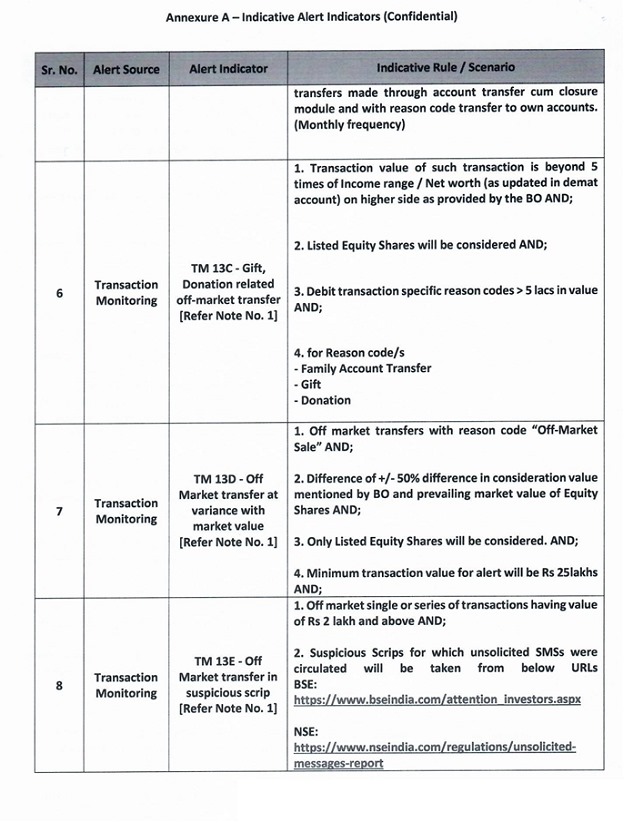

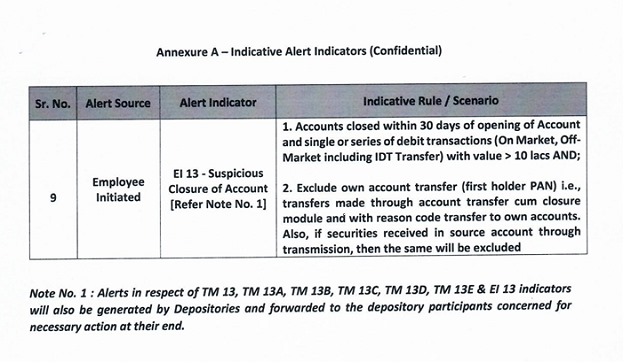

a) Implementation of RFI (Red Flag Indicator) as mentioned in the Annexure-A (The alerts generated by using the indicators as given in the guidelines should be properly analysed with a view to identify suspicious transactions as defined under the PML Rules and if appears to be a Suspicious Transactions, then the brought to the notice of FIU-IND by filing STRs):

2.10 Reporting to Financial Intelligence Unit-India

2.10.1 In terms of the PML Rules, we are required to report information relating to cash and suspicious transactions to the Director, Financial Intelligence Unit-India (FIU-IND) at the following address:

Director, FIU-IND,

Financial Intelligence Unit - India

6th Floor, Tower-2, Jeevan Bharati Building,

Connaught Place, New Delhi-110001, INDIA

Telephone : 91-11-23314429, 23314459

91-11-23319793(Helpdesk) Email:helpdesk@fiuindia.gov.in

(For FINnet and general queries)

ctrcell@fiuindia.gov.in

(For Reporting Entity / Principal Officer registration related queries)

complaints@fiuindia.gov.in

Website: http://fiuindia.gov.in

© 2026. Prrsaar Sampada Private Limited | All Right Reserved.

| BACK OFFICE SUPPORT : | 011-45350002/16 |

| OPEN AN ACCOUNT : | 011-45350014 |

| TECHNICAL SUPPORT : | 011-45350009/10 |

| CALL & TRADE (NSE,BSE,MCX,NCDEX) : | 011-45350019/20/22/36 |

| SURVEILLANCE : | 011-45350041/42/43 |

| DP SUPPORT : | 011-45350006/03 |

| COMPLIANCE : | 011-45350017/21/23 |